Creative Financing in Real Estate | Unlock Alternative Funding Options

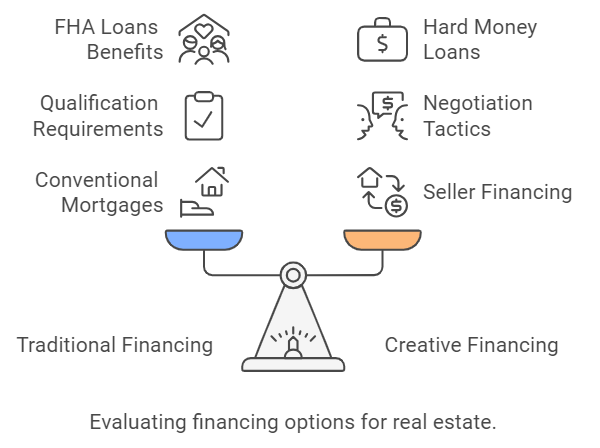

For real estate investors aiming to diversify and grow their portfolios, creative financing strategies offer powerful alternatives to traditional mortgages. By exploring innovative funding methods, investors can access unique opportunities to maximize returns and manage risk. In this guide, we’ll dive into these creative financing options, examine their benefits, and see how they fit into broader real estate investing strategies for a well-rounded investment approach.

Understanding Creative Financing

What is Creative Financing in Real Estate?

Creative financing refers to non-traditional methods of acquiring real estate that often involve unique arrangements between buyers and sellers. These approaches can provide flexibility, reduce costs, and open doors to investment opportunities that might otherwise be inaccessible.

Why Consider Creative Financing?

Advantages of Non-Traditional Methods

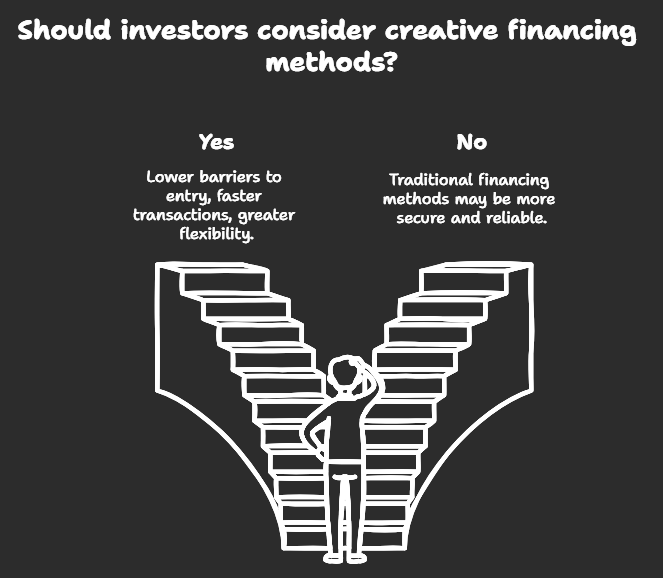

Creative financing can be particularly beneficial for investors looking to minimize upfront costs, avoid strict credit checks, or expedite the purchasing process. Here are some key advantages:

Lower Barriers to Entry : Many creative financing methods require less capital upfront, making it easier for new investors to enter the market. “Building and Scaling Your Real Estate Portfolio”

Faster Transactions : By bypassing traditional lenders, investors can often close deals more quickly, seizing opportunities as they arise.

Greater Flexibility: Creative financing arrangements can be tailored to fit both buyer and seller needs, allowing for more innovative deal structures.

Common Creative Financing Strategies

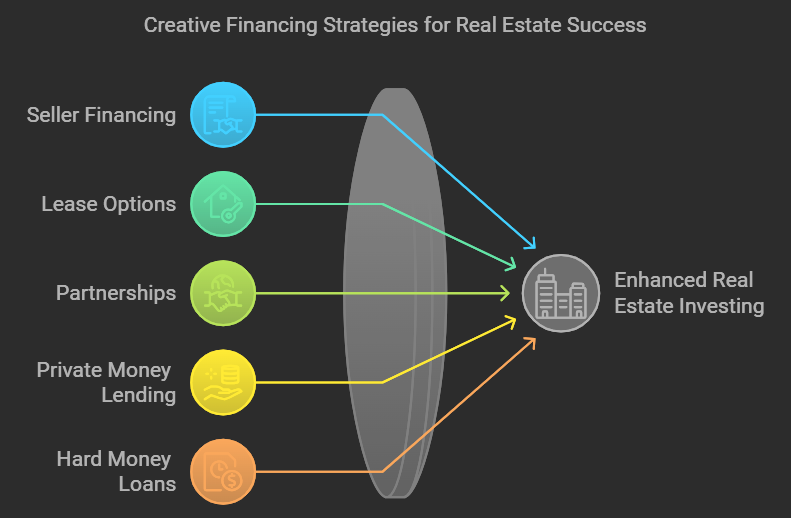

Here are some popular creative financing techniques that can enhance your real estate investing strategy:

1. Seller Financing

Empowering Buyers Through Direct Deals

In seller financing, the property seller acts as the lender, allowing the buyer to make payments directly to them rather than through a traditional bank. This arrangement can be advantageous for both parties, as it often involves fewer fees and a more straightforward approval process.

2. Lease Options

Rent Now, Buy Later

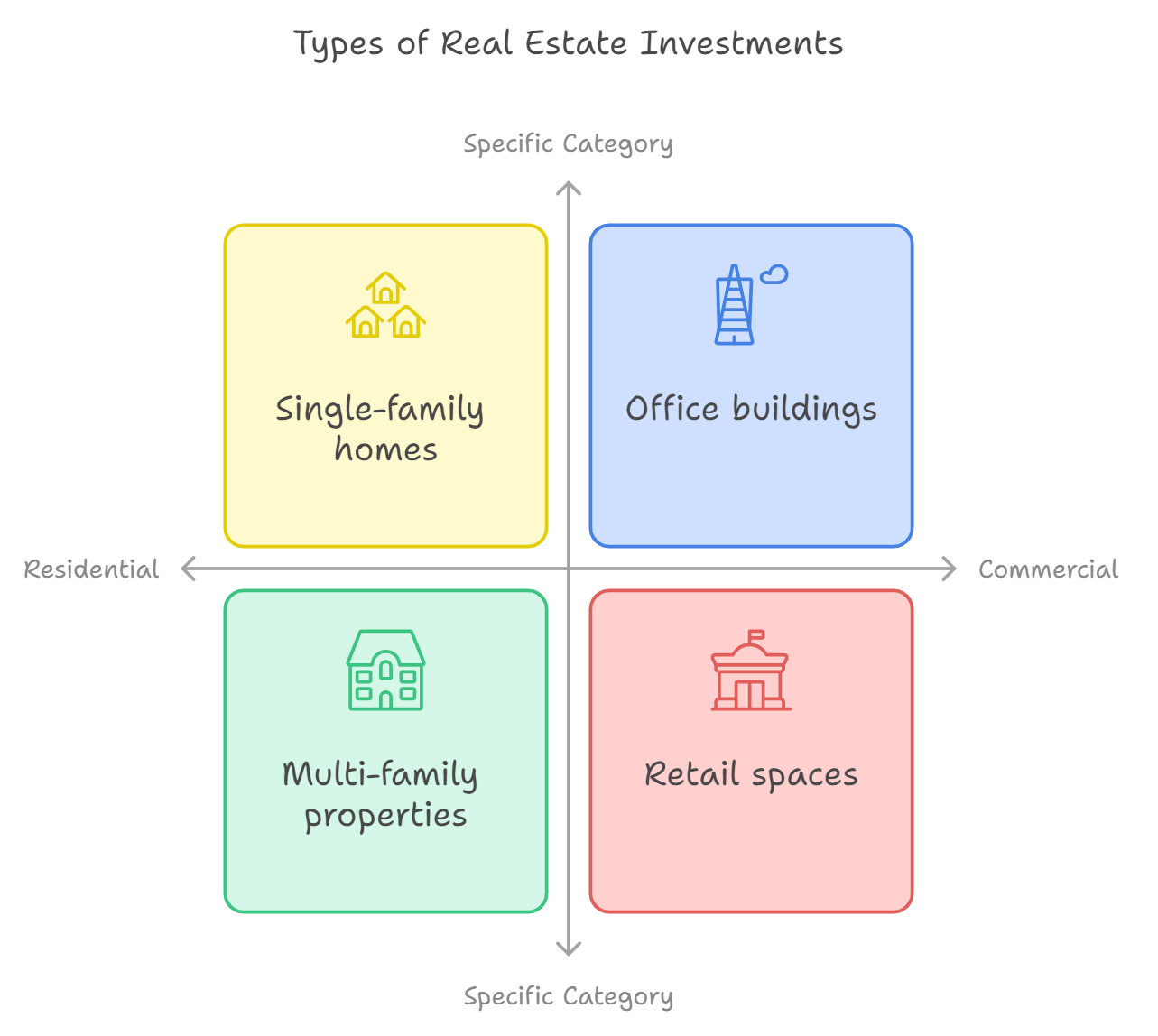

A lease option empowers investors to rent a property with the flexibility to buy it later. This arrangement allows tenants to build equity while experiencing the property firsthand, giving them confidence before committing to ownership—a choice that complements the decision-making process found in residential vs. commercial real estate investing.

3. Partnerships

Pooling Resources for Greater Success

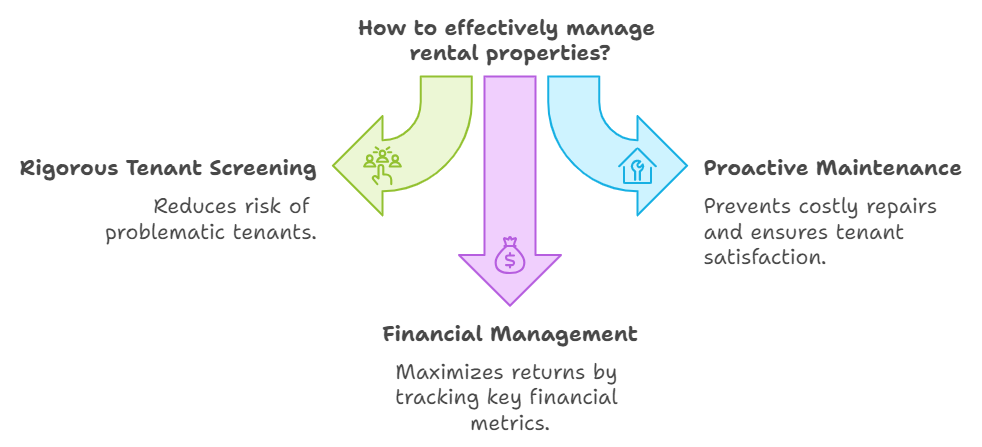

Forming partnerships can be an effective way to share financial responsibilities and risks. By collaborating with other investors, you can leverage their capital, expertise, and networks to enhance your investment strategy.

4. Private Money Lending

Funding from Individuals

Private money lenders are individuals who provide loans for real estate investments. This funding source can often come with more flexible terms compared to traditional lenders, making it an appealing option for investors seeking quick access to capital.

5. Hard Money Loans

Short-Term Solutions for Quick Deals

Hard money loans, secured by real estate, are offered by private investors or firms. While they come with higher interest rates and shorter terms, they provide quick funding for investors pursuing immediate property flips or other time-sensitive acquisitions. Understanding the potential risks tied to this type of financing is essential—especially as part of a broader approach to “risk management and insurance in real estate investing”.

Implementing Creative Financing Strategies

Tips for Successful Execution

To successfully implement creative financing strategies, consider the following steps:

- Research Your Options

Familiarize yourself with different creative financing methods to determine which aligns best with your investment goals. - Network with Other Investors

Building relationships with experienced investors can provide insights and opportunities for partnerships or alternative financing arrangements. - Consult Professionals

Working with real estate agents, attorneys, and financial advisors who understand creative financing can help you navigate the complexities of these strategies.

Conclusion

Creative financing offers real estate investors innovative ways to expand portfolios and boost profitability. By exploring options such as seller financing, lease options, and private lending, you can unlock strategies that align with your financial goals. For more insights on real estate investing strategies , take advantage of Trust Your Talent Academy’s free webinars and upcoming events. Here, we provide expert mentorship and practical resources designed to set you on a successful real estate journey.

Begin your path to financial independence with creative financing methods that work for you, and take your next step toward building “sustainable wealth through real estate” _ Real Estate for Financial Independence: Creating Sustainable Wealth’.

FAQs

Creative financing encompasses innovative funding methods for real estate investments that extend beyond traditional mortgage options. Strategies like seller financing, lease options, and hard money loans are all examples that can help investors expand their portfolios.

In seller financing, the property seller serves as the lender, allowing the buyer to make payments directly to them instead of going through a bank. This can facilitate a quicker sale and offer flexible terms for buyers who may have difficulty securing traditional financing.

A lease option allows tenants to rent a property with the potential to purchase it later. This strategy gives them the chance to build equity while assessing whether the property meets their needs before making a commitment.

Hard money loans are short-term loans secured by real estate, typically provided by private investors or companies. Although they often come with higher interest rates, these loans can be advantageous for investors needing immediate financing for urgent purchases or property flips.

Using creative financing can lead to greater flexibility, faster access to capital, and the ability to acquire properties that might not qualify for traditional financing. This approach can also assist investors in mitigating risks and maximizing their overall profitability.

Absolutely! Beginners can successfully use creative financing strategies by educating themselves about their options and seeking guidance. Resources like free webinars and mentorship programs provide valuable insights and support for new investors.

To dive deeper into real estate investing strategies, explore educational resources offered by Trust Your Talent Academy. They provide a variety of materials, including upcoming events and free webinars designed to equip you with the knowledge needed to succeed in your investment journey.