Fix and Flip vs. Buy and Hold: Comparing Popular Investment Strategies

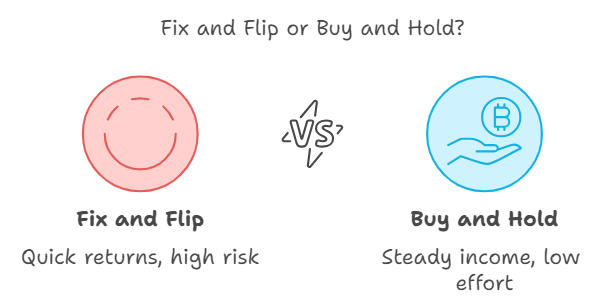

In the world of real estate investing, two strategies often stand out: Fix and Flip, and Buy and Hold. Each approach offers unique advantages and challenges, catering to different investor goals and market conditions. This guide will help you understand both strategies in depth, allowing you to make an informed decision on which path aligns best with your investment objectives.

For a broader overview of real estate investing strategies, check out our comprehensive guide on Real Estate Investing Strategies.

Fix and Flip Strategy

What is Fix and Flip?

Fix and Flip involves purchasing a property, renovating it to increase its value, and then selling it for a profit, typically within a short timeframe.

Key Characteristics of Fix and Flip

- Short-term investment: Usually completed within 3-12 months

- Active involvement: Requires hands-on management of renovations

- Potential for quick profits: Can yield significant returns in a short period

- Higher risk: Market fluctuations and unexpected renovation costs can impact profitability

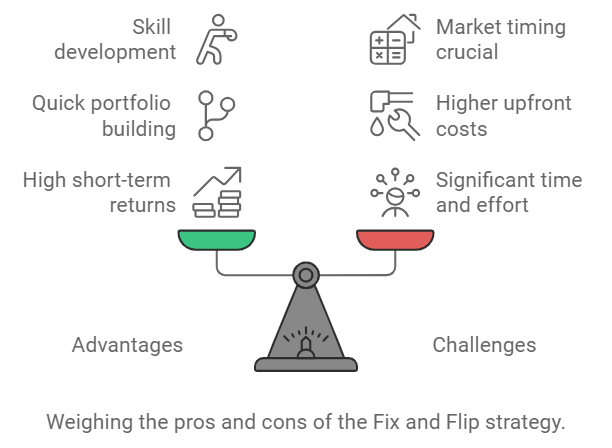

Advantages of Fix and Flip

- Potential for high short-term returns

- Opportunity to build a portfolio quickly

- Develop valuable skills in property valuation and renovation

Challenges of Fix and Flip

- Requires significant time and effort

- Higher upfront costs for renovations

- Market timing is crucial for maximizing profits

- Potential for unexpected expenses during renovation

Learn more about renovation strategies and cost management in our guide to property renovation.

Buy and Hold Strategy

What is Buy and Hold?

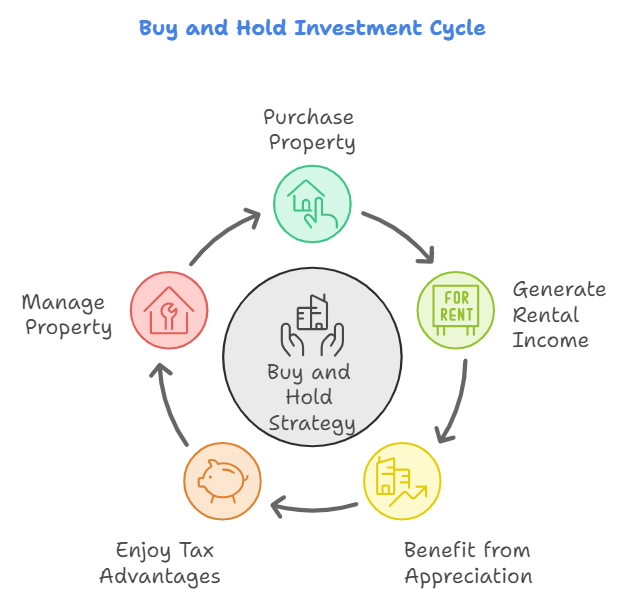

Buy and Hold involves purchasing a property with the intention of holding onto it for an extended period, typically generating income through rentals and benefiting from long-term appreciation.

Key Characteristics of Buy and Hold

- Long-term investment: Often held for 5+ years

- Passive income potential: Regular rental income

- Appreciation benefits: Profit from property value increases over time

- Tax advantages: Potential for deductions on mortgage interest and property depreciation

Advantages of Buy and Hold

- Steady, passive income stream

- Long-term appreciation potential

- Tax benefits for rental property owners

- Build equity as tenants pay down the mortgage

Challenges of Buy and Hold

- Requires ongoing property management

- Potential for problem tenants

- Market downturns can impact property values

- Less liquid investment compared to stocks or bonds

Discover effective tenant management strategies in our rental property management guide.

Comparing the Strategies

Financial Considerations

Fix and Flip

- Higher upfront costs for renovations

- Potential for quicker returns

- Short-term capital gains tax implications

Buy and Hold

- Lower ongoing costs (after initial purchase)

- Steady, long-term income potential

- Long-term capital gains tax benefits

For a detailed comparison of tax implications, see our guide on tax strategies for real estate investors.

Time and Effort

Fix and Flip

- Intensive short-term involvement

- Requires active management of renovations and sales process

Buy and Hold

- Less intensive day-to-day involvement

- Requires ongoing property management (can be outsourced)

Market Timing

Fix and Flip

- Highly dependent on market conditions for profitable sales

- Requires accurate prediction of short-term market trends

Buy and Hold

- Less affected by short-term market fluctuations

- Benefits from long-term market appreciation

Learn more about market analysis techniques in our real estate market analysis guide.

Skill Set Required

Fix and Flip

- Renovation and project management skills

- Market analysis for quick turnaround

- Negotiation skills for purchases and sales

Buy and Hold

- Property management skills (or ability to hire managers)

- Tenant screening and relations

- Long-term market analysis

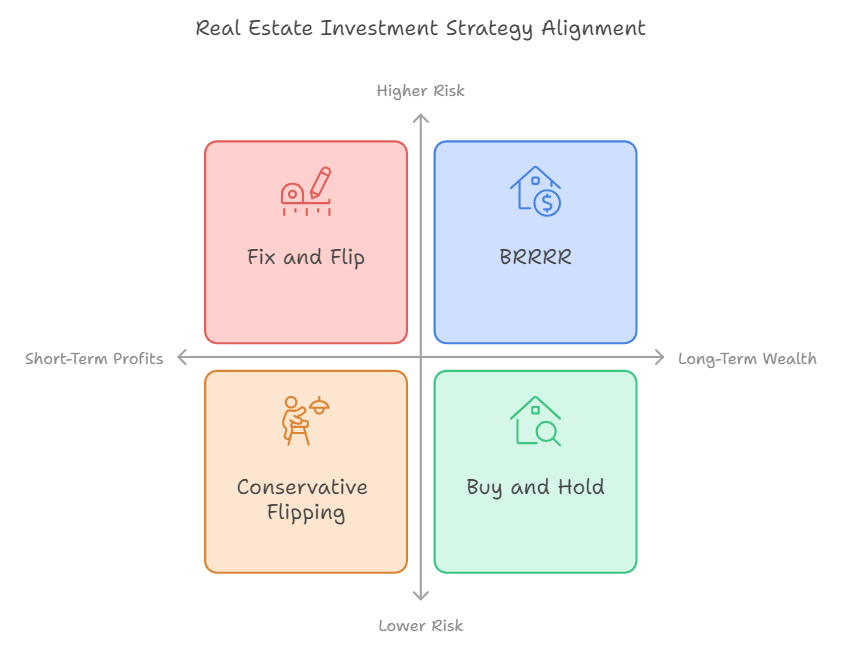

Choosing the Right Strategy for You

Factors to Consider

- Financial goals: Short-term profits vs. long-term wealth building

- Time availability: Active vs. passive involvement

- Risk tolerance: Higher short-term risk vs. lower long-term risk

- Market conditions: Hot sellers’ market vs. stable rental market

- Personal skills and interests: Renovation expertise vs. property management

Hybrid Approaches

Some investors combine elements of both strategies:

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat)

- Fix, flip, and hold a portion of properties

Learn more about creative real estate investing strategies in our comprehensive guide.

Tools and Resources

For Fix and Flip Investors

- Renovation cost estimators

- Local market analysis tools

- Contractor management software

For Buy and Hold Investors

- Property management platforms

- Tenant screening services

- Long-term real estate market forecasting tools

Explore more real estate investing tools and technologies in our guide to leveraging technology in real estate investing.

Conclusion

Both Fix and Flip and Buy and Hold strategies offer unique paths to real estate investing success. Your choice should align with your financial goals, risk tolerance, and personal strengths. Remember, many successful real estate investors incorporate elements of both strategies as they build their portfolios.

At Trust Your Talent Academy, we believe that education is the foundation of successful real estate investing. Whether you’re leaning towards fix and flip or buy and hold, our comprehensive courses can provide you with the knowledge and skills you need to excel in your chosen strategy.

Ready to take the next step in your real estate investing journey? Here are some ways to leverage our resources:

- Schedule a strategy session with one of our expert mentors to develop a personalized investment plan tailored to your goals and resources.

- Explore our course catalog to find specialized training in fix and flip techniques, buy and hold strategies, and everything in between.

- Connect with like-minded investors and industry experts at our upcoming events, including workshops, seminars, and networking opportunities.

Remember, successful real estate investing is not just about choosing the right strategy—it’s about continuous learning, adaptation, and growth. Trust Your Talent Academy is here to support you every step of the way on your path to financial independence through real estate investing.

Frequently Asked Questions

Both can be suitable for beginners, depending on their skills and resources. Buy and hold might be less intensive to start, while fix and flip can provide valuable hands-on experience.

The initial investment varies greatly depending on your location and the type of properties you’re targeting. Generally, fix and flip requires more upfront capital for renovations.

Yes, many investors pursue fix and flip as a full-time career. However, it requires significant time, effort, and expertise to be consistently successful.

Fix and flip profits are typically taxed as ordinary income, while buy and hold can offer tax advantages through depreciation and long-term capital gains.